To access the Sales Tax Report

1. Go to your Dashboard.

2. Click on the “Sales Tax Report” link.

3. Follow the instructions to generate a report by selecting your preferred reporting method and date range.

Report Details

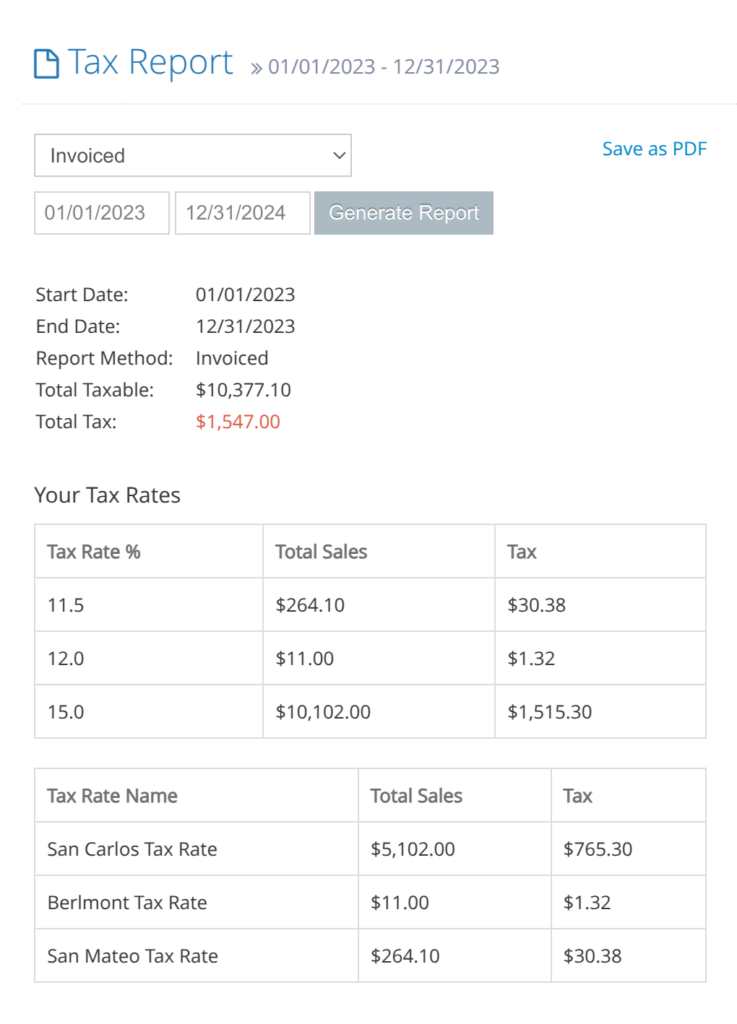

1. The report displays your sales tax amounts, broken down by tax rates.

2. It includes a detailed list of invoice line items from which sales taxes are derived.

3. Additionally, a list of line items with zero sales tax is provided.

Invoiced vs. Collected Modes

- Invoiced Mode: Sales tax data is based on the invoice issue date.

- Collected Mode: Sales tax data is based on the “Paid Date,” the date an invoice is marked as paid. The system automatically sets this date when an invoice’s status changes from “Pending Payment” to “Paid.”

- In our latest update, the “Paid Date” field is now editable, allowing you to manually adjust it if necessary.

- Note: This feature is currently in beta. Contact our support team for early access.

Paid Date Field

When selecting the Collected method, Yardbook automatically identifies invoice items based on the date each invoice was marked as “Paid.” This “Paid Date” is set automatically when an invoice’s status changes from “Pending Payment” to “Paid.”

With our latest update, you are now able to manually adjust the “Paid Date” if needed. This added flexibility ensures accuracy in your reporting.

This feature is currently in beta. If you’re interested in early access, please reach out to our support team.